At the conclusion period of every financial year, Indians are supposed to pay a lump sum amount of tax as a certain percentage of their annual income. Usually, the number of these taxpayers in India is around 8.45 crore. However, more than half of these taxpayers try to find out different decent ways to get rid of this process and want to save their money. And yes, this is absolutely possible. If you are not aware of this, let us inform you that the Government of India allows people to claim their income tax exemption under section 80G, but for that, the taxpayers are liable to make some donations to specific funds and charitable organizations.

Under Section 80G, people get several proper ways to achieve tax exemption if they donate something. Like, if you donate land to any government body and collect the certificate, or donate securities to any charitable organization which is authorized by the state or central government, and so on, you can achieve the tax exemption option in India.

Already, donating something makes people feel good and, in this case, it also helps to save taxes as a bonus. Let’s dive into the concept more deeply.

What is Section 80G in the Income Tax Act?

Section 80G of the income tax act helps taxpayers to get an income tax deduction if they make any donation to charitable institutions or any specified trusts, certain funds, and so on.

So, it is easily understandable that the aim of this whole matter is to provide tax incentives to the persons indulging in any philanthropic activity. But, the amount and the charity institute have to fulfill the eligibility criteria and after that, the individuals can claim their tax deduction while filing their income tax return.

Eligibility criteria for Exemption from Tax Under Section 80G

This deduction can be avail by any taxpayer. So, naturally, any Indian taxpayer can become eligible for this “tax exemption under section 80G of the Income Tax Act”. But they need to be made sure that they are donating to the pre-decided and specified charity or religious organization. It does not matter, whether you are an individual or an organization, you can easily claim the exemption by submitting some documents. Those are mentioned below-

⦁ Name of the charitable trust

⦁ Address of the charitable trust

⦁ Name of the donor

⦁ The donated amount (that too in figures as well as words)

⦁ The Registration Number of the charitable trust along with its validity.

It is needed to mention that, taxpayers can be individuals, any company, or Hindu Undivided Families who are eligible for making donations to the charity under Section 80G.

However, all donations are not treated in the same way and some limitations are set down by the government. Also, NRIs can get benefits under Section 80G, provided their donations are to eligible trusts or institutions.

The taxpayers should also be aware of the fact that if they donate something to any political party or any foreign trust, that will not come under section 80 of the “Income Tax Act”. Deductions will not be approved by donating to any of these charitable trusts. So, the taxpayers need to pay their taxes for any noble cause or can donate to any verified charitable trust in India.

Section 80G Deduction

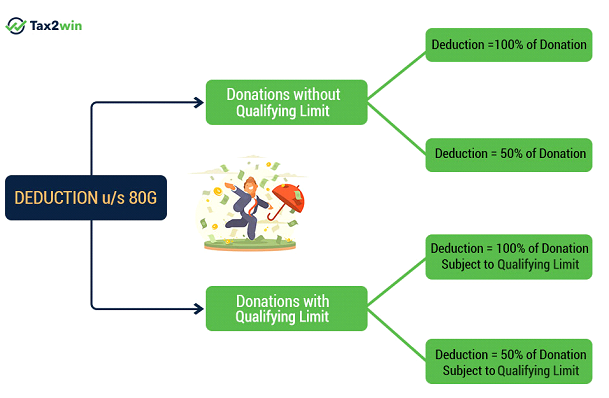

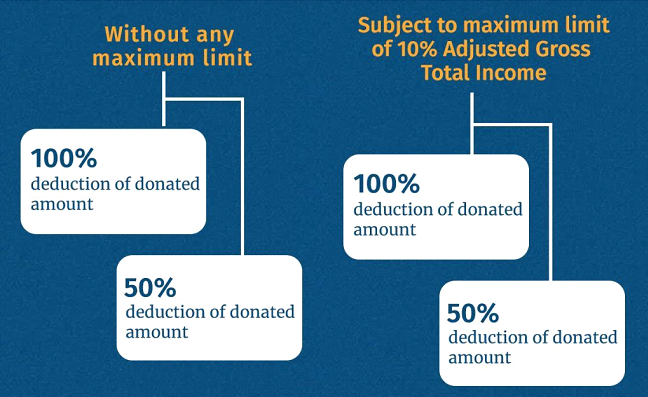

You should have the information about certain conditions which are needed to be followed for the deduction process under Section 80G. The entire process is classified into 4 categories.

(i) Without Any Maximum Limit

⦁ 100% Deduction

Taxpayers can get a 100% exemption of their tax under this particular category. The fund and charities which fall under this category are National Defence Fund, The National Foundation for Communal Harmony, Prime Minister’s National Relief Fund, the National or State Blood Transfusion Council, and many others.

⦁ 50% Deduction

In this category, the qualifying charities and funds are National Children’s Fund, Prime Minister’s Drought Relief Fund, Indira Gandhi Memorial Fund, and many more. The taxpayers will get a 50% deduction and that too without any qualifying limit.

Section 80G

(ii) Maximum Limit of 10% of Adjusted Gross Total Income

⦁ 100% Deduction

This category refers to the donations which are processed for government or local authorities to promote family planning programs along with the Indian Olympic Association. However, in this case, only 10% of the “Adjusted Gross Total Income” of the taxpayer will be entitled to deductions.

50% Deduction

In this category, under section 80G, donations should be made to government or local authorities and that must be used for any charitable drives. Only 10% of the “Adjusted Gross Income” usually becomes eligible for these deductions. However, the amount exceeding this limit will be covered at 10%.

Required Documents to Claim a Deduction under Section 80G

Taxpayers must keep all the documents to claim their exemption under Section 80G which are mentioned below-

⦁ The proper receipt of the donations.

⦁ Form 58 needs to be submitted if the donations come under the 100% category

⦁ Photocopies of the 80G certificate

⦁ Registration number of the charitable trust

Payment Mode for donations

The amount has to be more than Rs 2000 and that should be mentioned in the form of a cheque, demand draft, or through any digital payment mode. An amount up to Rs 2000 can be donated in cash form.

Also, donations will make in form of food, clothes, or medicines will not qualify for the exemption.

Donations that are qualified for 100% Deduction without any qualifying limit

⦁ Prime Minister’s National Relief Fund

⦁ Chief Minister’s Relief Fund

⦁ National Sports Fund

⦁ National Foundation for Communal Harmony

⦁ National Trust for Welfare of Persons with Autism, Cerebral Palsy, Mental Retardation, and Multiple Disabilities

⦁ Africa (Public Contributions – India) Fund

⦁ National Illness Assistance Fund

⦁ Swachh Bharat Kosh (applicable from FY 2014-15)

⦁ National Children’s Fund

⦁ National Blood Transfusion Council or any State Blood Transfusion Council

⦁ National Cultural Fund

⦁ Clean Ganga Fund (applicable from FY 2014-15)

⦁ National Defense Fund by the Central Government and many others

Donations that are qualified for 50% exemption without any qualifying limit

⦁ Jawaharlal Nehru Memorial Fund

⦁ Indira Gandhi Memorial Trust

⦁ Rajiv Gandhi Foundation

⦁ Prime Minister’s Drought Relief Fund

Conclusion

So, at the end of this topic, it can be said that Section 80G provides an effective as well as an easy way to achieve tax deductions. Thus, let’s save the taxes and at the same time help other people who are in need.